Metaplanet buys $118M in Bitcoin during dip – Now holds over $1B in BTC

- Metaplanet’s BTC stash hit 11.11k worth over $1 billion

- Metaplanet withstood the recent geopolitics-driven market dump better than BTC

Japan-based Metaplanet is in the news today after it maximized the latest Bitcoin dip and acquired $118 million BTC – Increasing its stash to over $1 billion (11,111 coins).

According to the firm’s disclosure documents, the latest $210 million bond issuance facilitated the purchase.

“On June 16, 2025, the Company issued the 18th Series of zero-coupon, non-interest-bearing Ordinary Bonds to EVO FUND, raising USD 210 million, also for the purpose of acquiring Bitcoin.”

Like Michael Saylor’s Strategy (formerly MicroStrategy), Metaplanet uses debt and stock sale to fund its BTC buying program.

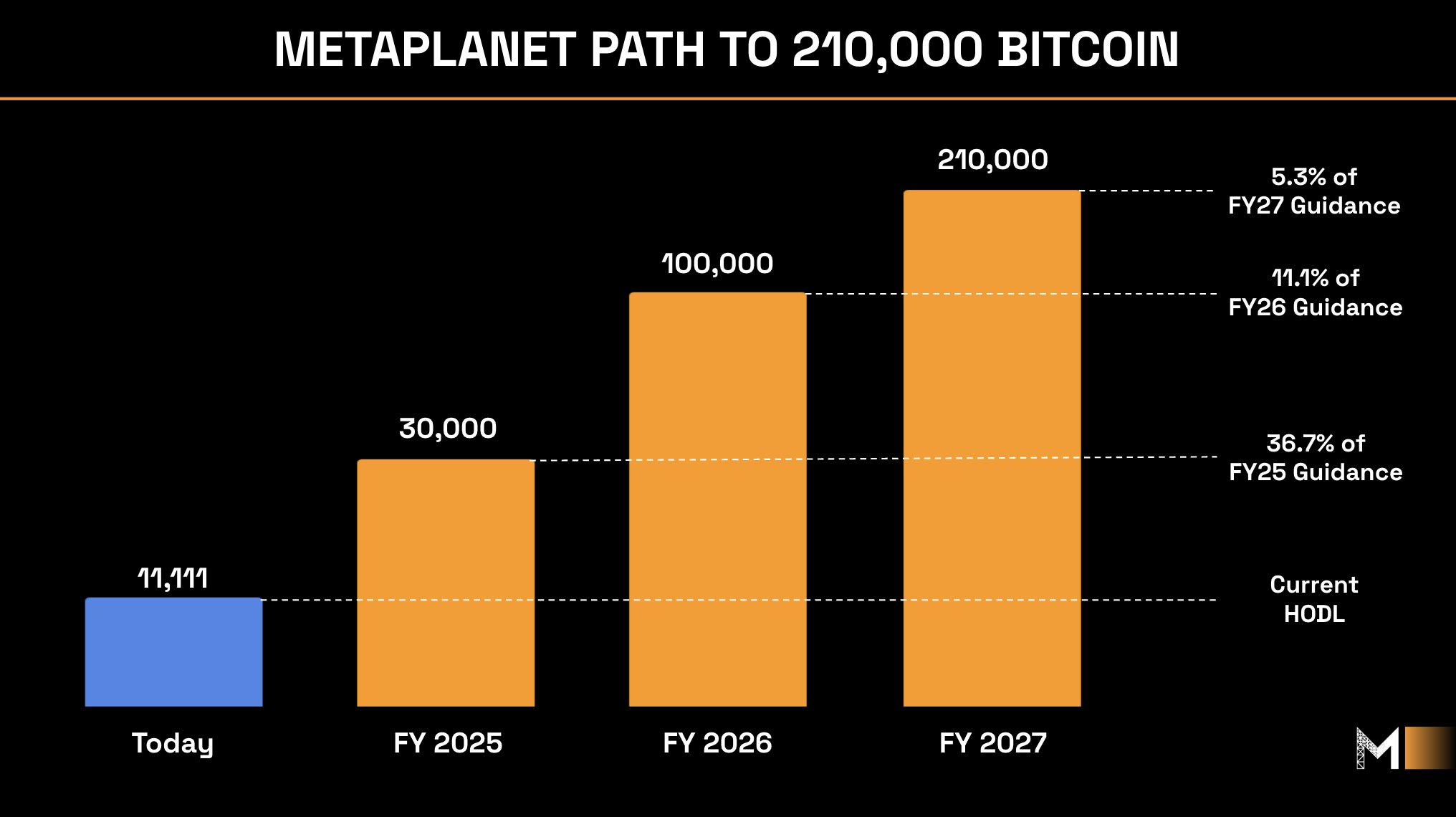

Metaplanet eyes 30K BTC in 2025

Notably, the firm has raised its 2025 BTC holding target from 10k to 30k, meaning it still has about 19k BTC to go. So, the current holdings are about 36% of 2025’s target, with 64% left to be plugged.

Assuming BTC remains at its press time value, that would mean about $2 billion in capital to achieve the target.

However, the aggressive plan will not stop at 30k. By 2026, Metaplanet aims for 100,000 BTC, while scaling to 210k by 2027 – Just a year before the next Bitcoin halving period in 2028.

At current prices, Metaplanet would need over $20 billion to fund the remaining 198k BTC remaining to hit the 210k BTC target in two years.

At press time, the firm still had a capital war chest with an outstanding 600 million shares to be issued. This would translate to about $7.2 billion at current share value.

On the debt side, Metaplanet has a collective of $293 million pending debt via recently issued bonds.

For perspective, this dwarfs Strategy’s over $8 billion in debt, set to mature from 2027. That being said, Metaplanet’s mNAV (net asset value), a key valuation indicator for BTC treasuries, eased slightly to 6.15.

The indicator was above 7 when BTC’s price was above $110k. What this implies is that investors are still bullish on the firm’s BTC plan.

At its current mNAV level, Metaplanet remains on the right track. Unless the mNAV drops below 1.

Meanwhile, Metaplanet’s stock withheld the macro-driven dump better than BTC over the past five days of trading. At the time of writing, Bitcoin was down 3% at $101k while Metaplanet was up 12% over the same period.