Dogecoin price prediction: Here’s why bulls should prepare for a 20% rally

- Dogecoin’s weekly structure showed some hope in the long term, and consolidation conditions in the coming weeks.

- Swing traders would be buoyed by the DOGE reaction at $0.142 and could look to enter long positions.

Dogecoin [DOGE] retested the $0.142 support level from April, which had been a range low at the time.

AMBCrypto’s analysis showed that there was reason to think that Dogecoin was still trading inside a range, despite its May rally.

The weekly chart showed a bullish swing structure, as highlighted by the Fibonacci retracement levels plotted from this swing move’s low and high, made toward the end of 2024.

The leading memecoin has not fallen below the $0.089 swing low, but its internal structure (sub-structure) was bearish.

To flip this internal structure bullishly, Dogecoin must push above the $0.259 local high.

The OBV retested a low from March, while the RSI outlined bearish momentum had the upper hand. The low trading volume over the past two months suggested a potential consolidation phase.

The March-April range formation was worth exploring deeper.

Extending the range helps with the Dogecoin price prediction

Previously, the mid-range level was thought to be the top of the range, formed in March and April. The breakout in May reached $0.259, before retracing its rally and reaching $0.142.

Extending the range showed that the former range high became the mid-range level, which has served as both support and resistance in recent months.

While the OBV was at March lows, the CMF showed strong buying pressure in recent days, with a reading of +0.13.

Hence, even though the moving averages could be dynamic resistances, it appeared likely that DOGE would rally to the $0.2 supply zone.

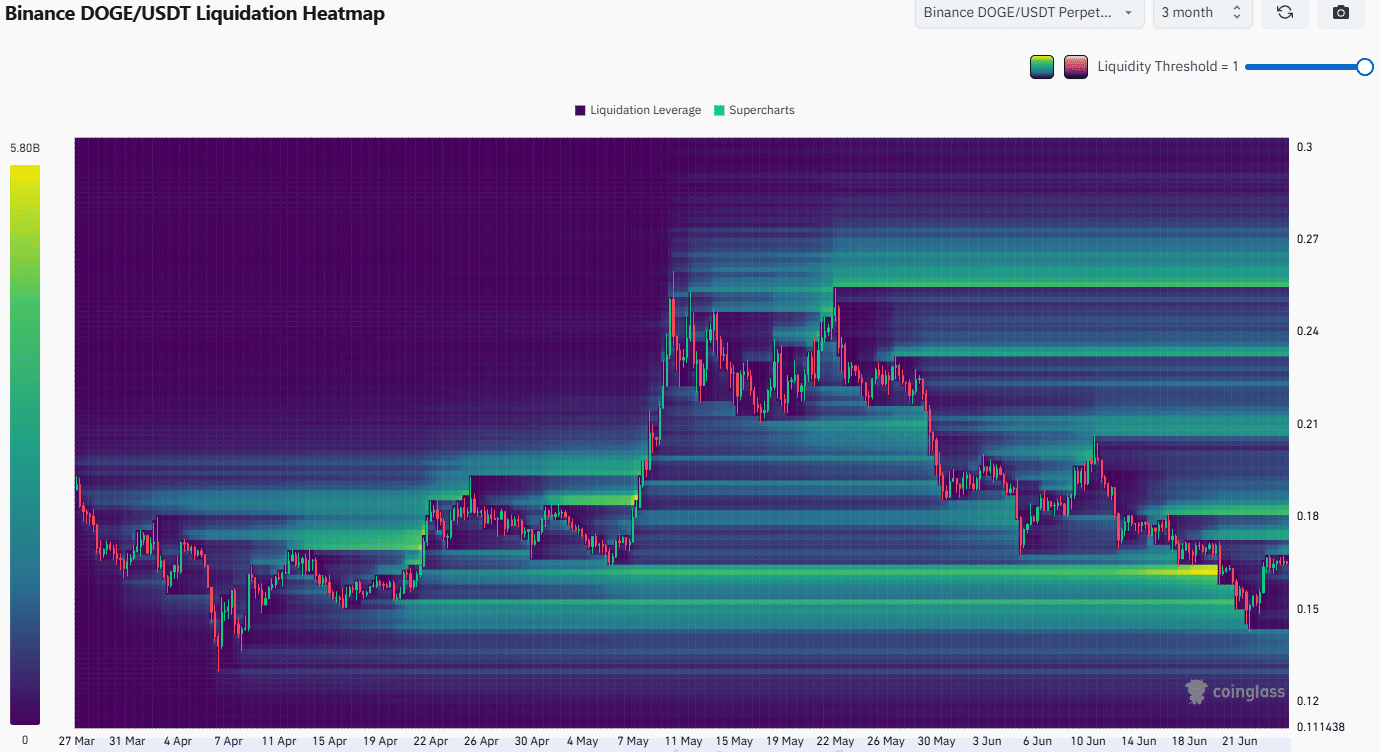

Source: Coinglass

The 3-month liquidation heatmap showed that the pocket of liquidity from $0.145-$0.162 has been swept.

Smaller clusters of liquidity had built up overhead at $0.173 and $0.182, which could be immediate price targets for the DOGE bounce.

The next notable magnetic zone lay at $0.21, which lined up well with the mid-range resistance.

Hence, swing traders could look to buy Dogecoin, with a stop-loss at $0.154 (below the daily fair value gap), with the $0.198-$0.2 region as the take-profit target.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion