Dogecoin dips 16% in a week, yet a $0.25 rally could be loading – HOW?

![Dogecoin [DOGE] drops 16% – But is a $0.25 rally now loading?](https://ambcrypto.com/wp-content/uploads/2025/06/08519350-41B0-4D47-8530-DADB272A4AD3-1200x675.webp)

- DOGE, despite ranking high in market capitalization, has attracted the lowest liquidity among top memecoins.

- Analysis showed that DOGE could reach new heights, as technical indicators point to a potential breakout.

Dogecoin [DOGE] declined by 16.23% in the past week, marking a significant drawdown for investors.

However, analysis suggests that DOGE may resume a bullish move this week, with the asset trending upward as both spot accumulation and derivative long bets increase simultaneously.

Low liquidity puts DOGE behind

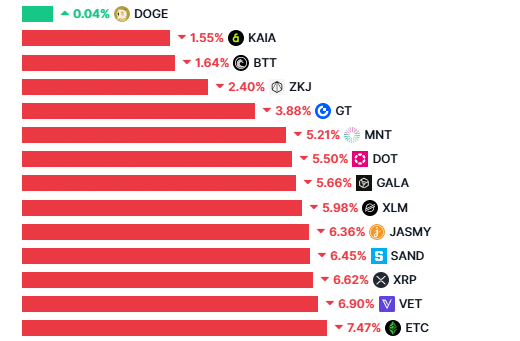

CoinMarketCap’s 90-day performance index shows that among the leading memecoins by market capitalization, Dogecoin has attracted the least liquidity, despite holding a $28.6 billion market cap.

As of writing, DOGE has gained only 0.04% in the past ninety days. In contrast, FARTCOIN, with a $1.11 billion market cap, has surged by 368% over the same period.

Despite this underperformance, market analysis indicates that DOGE could be gearing up for a rally.

On the daily timeframe, Dogecoin has traded into a critical level—an ascending support line.

This zone could act as a catalyst for a major price move, with a target set at $0.25, representing a 33% rally from the current price level.

However, if DOGE fails to build sufficient momentum, the price could reverse and retest the origin of the ascending pattern near $0.14.

Retail traders are taking sides

Retail traders have begun taking positions in the derivatives market, with a noticeable uptick in long bets.

At press time, the Long/Short Ratio stood at 1.01, signaling a tilt toward bullish sentiment. A ratio above 1 implies higher buying volume than selling volume, which strengthens the case for a rally.

A close examination of Open Interest (OI) in both options and futures contracts shows a steady rise. OI represents the total value of unsettled derivative contracts within a specific period.

At the time of writing, OI in the Futures market has reached $2.06 billion, while the options market stands at $347,000. Sustained growth in OI alongside increasing buy volume suggests that DOGE may continue climbing.

DOGE could see more inflows

In the past 24 hours, DOGE has seen notable inflows, with $4.77 million worth of tokens moved into private wallets by spot traders.

When a large amount of tokens moves off exchanges and into private wallets, it typically indicates accumulation in anticipation of a long-term rally.

This also implies that the tokens are less likely to return to the market for sale. If such inflows continue, DOGE could trend toward the $0.25 target outlined on the chart.

![Bitcoin [BTC] social sentiment hit a 2.1 bullish-to-bearish ratio, the highest since Nov 2024.](https://ambcrypto.com/wp-content/uploads/2025/06/Evans-98-min-400x240.png)