Mapping Bitcoin’s road ahead after brutal $160M bloodbath

- Bitcoin saw $160 million in long liquidations and -$100M Taker Volume as speculative leverage got flushed out.

- BTC’s Stock-to-Flow hit 396, and its Stablecoin Ratio signaled that buyer firepower remained sidelined.

Bitcoin [BTC] dropped below $103K, triggering a $160 million long liquidation cascade on Binance. This wipeout followed the unwinding of a highly leveraged cluster that had been building for days.

Simultaneously, Binance’s Net Taker Volume plummeted to -$100 million, confirming intense selling pressure from market orders.

Panic forced the market to reset, pushing out overexposed longs in a flash.

Such liquidation-driven resets often mark short-term bottoms, especially when accompanied by signs of rising spot accumulation and reduced leverage.

Capitulation or cleansing?

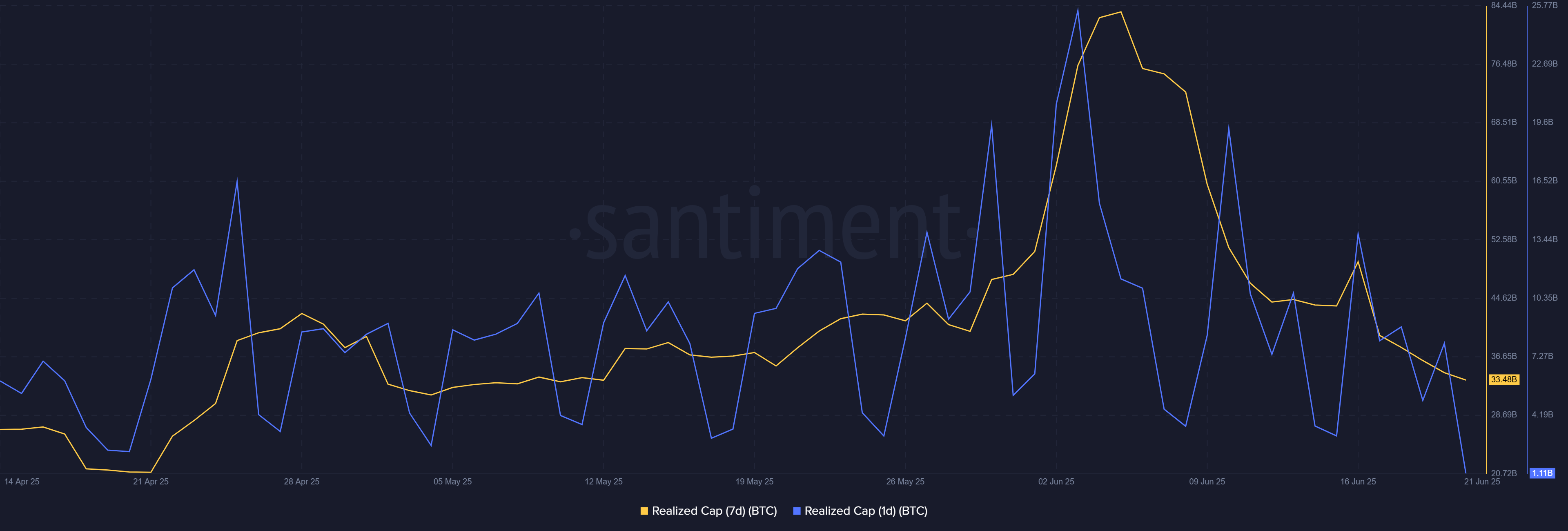

Now here’s where it gets more layered. BTC’s 7-day Realized Cap fell to $33.48 billion, while the 1-day variant collapsed to $1.11 billion, according to Santiment.

This steep contraction revealed diminished realized profits and fading market participation.

Rather than pure bearishness, this compression signals potential deleveraging. It suggests that short-term speculation may be getting flushed out of the system, possibly setting the stage for a more stable buildup.

Are STHs stepping back?

BTC’s short-term holder activity plunged, evidenced by the Realized Cap HODL Waves (1d to 7d) dropping from above 8% to nearly 3.6%.

These market participants, often driven by hype or panic, have capitulated.

At the same time, the Stock-to-Flow (S2F) Ratio surged to 335—its highest level this cycle—indicating extreme supply scarcity.

Together, this combo of seller exhaustion and supply constraints paints the early signs of recovery potential.

Does THIS point to sidelined firepower ready to deploy?

Now let’s talk liquidity. The Exchange Stablecoin Ratio sat at 5.45, with a -1.23% daily change. This means stablecoins now make up a higher share of assets on exchanges.

A declining ratio often shows stronger potential buying power, as more funds remain in reserve rather than being deployed.

Liquidity hasn’t fled the market; it’s on standby. If sentiment stabilizes, that capital may quickly rotate into BTC positions.

Will bears stay in control?

BTC traded around $103,569, just below the 0.236 Fibonacci level at $105,245, at press time. Despite this, it held the $102K support line through multiple tests.

Meanwhile, the 9-day and 21-day moving averages have yet to flip bullish.

If bulls reclaim the 0.382 or 0.5 levels, upward momentum could build toward the $110K–$112K range.

Therefore, while the structure looks shaky, BTC still holds a chance to bounce if accumulation strengthens near this range.

Is the worst behind, or could BTC face more downside?

Bitcoin’s $160M liquidation flush, paired with negative Net Taker Volume and collapsing short-term conviction, suggests the market has cleared excessive leverage.

At the same time, extreme scarcity and available buying power hint at a brewing reversal.

Therefore, while caution remains necessary, the odds are tilting toward a stabilization phase that may support gradual recovery if bulls defend the $102K–$103K range.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)