Bitcoin treasury hype will burst like memecoin supercycle – Crypto VC

- Crypto VCs projected that the crypto treasury trend will burst like the ‘memecoin supercycle.’

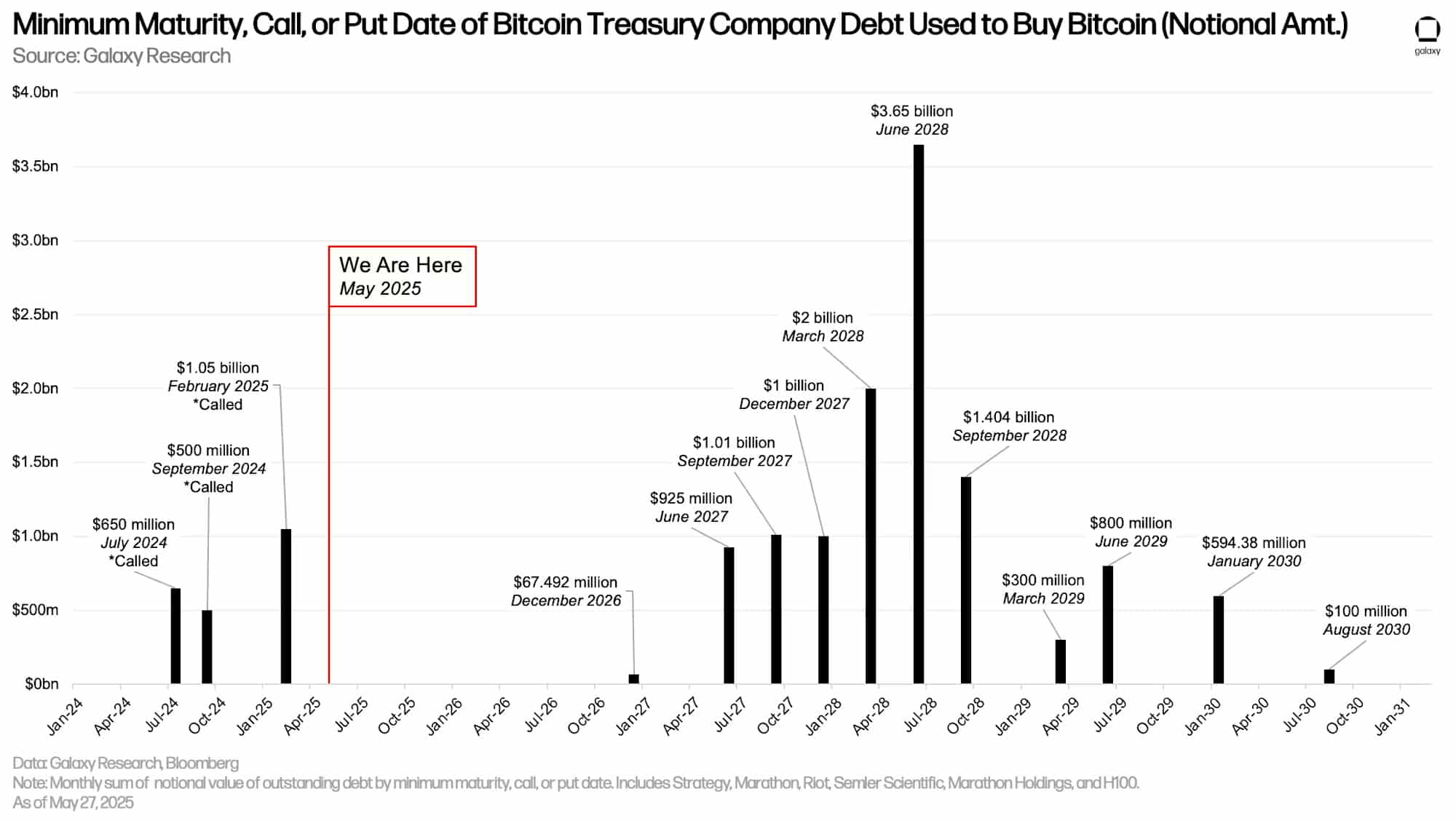

- Nearly $10 billion of outstanding debt by Bitcoin treasury firms will mature in 2027-2028.

Bitcoin [BTC] treasuries and copy-cats based on Ethereum [ETH] and altcoins will be over within two years, according to Haseeb Qureshi, founder of crypto VC Dragonfly.

In an X post, Qureshi linked the ‘treasury meta’ to ‘hot money’ that will end like last year’s token launch.

“But hot money never stays put, which is why treasury companies will not be the final meta. But I’d guess 1-2 years of this until the heat dies down.”

Will treasury firms blow up?

Zaheer Ebtikar, founder of crypto fund Split Capital, echoed Qureshi’s remarks but added that the narrative will be shorter than the ‘memecoin supercycle.’

“Markets get smarter over time, and as a result, every new meta is shorter and shorter lived…Memecoin euphoria, now —> public vehicles. They all live shorter lives as a function of market forces.”

Bitcoin and Ethereum treasuries collectively hold about $367 billion worth of capital as of June. Notably, BTC-focused firms hold 3.44 million BTC or $364B based on the current market price.

On the other hand, ETH treasury firms have accumulated 1.16 million ETH, worth $3 billion.

Notably, most of the BTC flows from public treasuries are driven primarily by Strategy and Metaplanet. However, some analysts have raised concerns that these firms’ debt leverage to acquire BTC could trigger a market crash if they go bankrupt.

In response, Galaxy Digital’s Alex Thorn rebutted the claims, stating that debt concerns were ‘overblown’ because most maturities will begin in 2027.

For perspective, BTC treasuries have $12.7 billion in debt, and Strategy dominates at $8.2B or 64% of the total debt.

Nearly $10 billion of the debt stock is due for payment between 2027 and 2028. This timeline fits well with Qureshi’s projection, in case the bubble bursts.

Source: Galaxy Research

Overall, the crypto treasury meta has been printing more returns than the underlying assets, attracting most investors.

However, for risk management purposes, the 2027-2028 period could be a key watchlist, especially if the firms fail to pay back their debt.